The Surge credit card reports monthly to three major credit reporting agencies, allowing customers to begin restoring their credit history immediately. Those who have never owned a credit card before can also build credit with the Surge Credit Card. Customers can view their monthly credit scores on their electronic statements through their online Surge credit card account. The credit card issuer’s website states that initial credit limits range from $300 to $1,000, and customers are eligible to increase credit limits after just six months. It doesn’t matter whether you received an offer in the mail; you can apply online for the Surge Mastercard.

The credit card issuer’s website states that initial credit limits range from $300 to $1,000, and customers are eligible to increase credit limits after just six months. It doesn’t matter whether you received an offer in the mail; you can apply online for the Surge Mastercard.

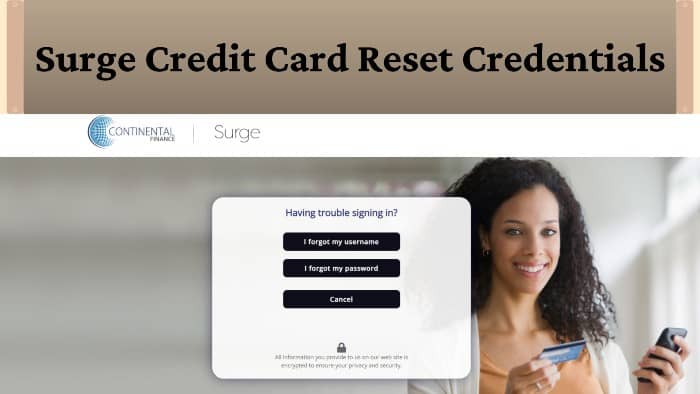

How To Recover Surge Credit Card Login Details?

Many of us easily forget our passwords, so this shouldn’t come as a surprise. It’s something we all do at some point. But don’t worry, it’s not a severe problem. Getting your credentials with a Surge Credit Card is very convenient. Follow these steps to get your username or password:

- For more information about your credit card, visit yourcreditcardinfo.com.

- On this page, under the login button, you will see a link titled “Forgot your username or password.”

- Below the Forgot Username or Password button is a link that opens a new window. Entering this information will verify your account information.

- You will be emailed your login details shortly after verification.

How to Use the Surge Credit Card

To get the most out of your Surge card, use it to make a small purchase throughout the month, then pay your balance in full when your account statement arrives. Over time, as you make payments on time and keep producing, your credit report should begin to reflect your solid financial performance.

Never keep a balance on your Surge card. The exorbitant APR on the card means carrying a balance is very expensive and should always be avoided. Use your Surge credit card only to improve your bad credit score, not for purchases you can’t afford right away.