On behalf of Continental Finance, Celtic Bank has the authority to issue a Surge Credit Card Login. Celtic Bank offers all services like making Surge payments online and accessing your account online on behalf of continental Finance, and submitting Surge Credit Card Reviews.

On behalf of Continental Finance, Celtic Bank has the authority to issue a Surge Credit Card Login. Celtic Bank offers all services like making Surge payments online and accessing your account online on behalf of continental Finance, and submitting Surge Credit Card Reviews.

The Surge credit card is designed for those with less than perfect credit, so anyone with any credit score can apply. The Surge Mastercard is issued by Celtic Bank and managed by Continental Finance. It includes financial products and services designed to help consumers regain their credibility.

How To Get Registered At www.surgecardinfo.Com?

Registration is the pathway to get the login credentials for your Surge credit card. Similarly, registration of your Surge credit card to avail of all services online is mandatory, and the following are the steps for it:

- Go to www.surgecardinfo.com.

- You will see a “Register Now” button on the right bottom. Click on that button, and it will take you to a new window.

- Clicking on the” Register Now” button will open a registration window. There will be some information necessary for the verification of your identity.

- Enter the last four digits of your credit card, the last 4 of your SSN (Social Security Number), and a 5-digit zip code. After inputting these credentials, click the “Lookup Account” button.

- Clicking the Lookup Account button will take you to another page. Please enter all the required data in the respective spaces to get the login information and hit the Register button.

- Your account is registered and ready for login don’t forget to submit your Surge Credit Card Reviews

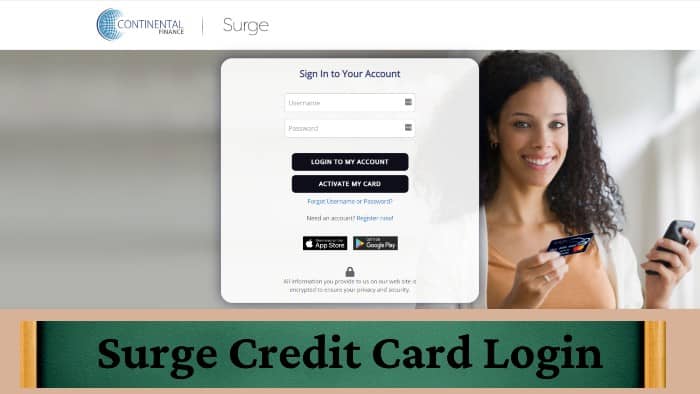

How Does Surge Credit Card Login Work?

This Card comes from one of America’s most dominated financial institutions, rated A+ by the Better Business Bureau. Therefore, you can quickly do a Surge Credit Card login and enjoy fast transactions on the go. You can easily log in to the Surge credit card after registration. The steps are as below:

- Open www.surgecardinfo.com in your browser. It will directly open the login window of Surge Credit Card Login.

- Input your “username” and “password” in the respective boxes.

- Click the “login to my account” button.

- You are now in. Therefore, you can use all the benefits of Surge Credit Card Login.

It is best for people who:

- Have fair or poor credit and need to build or repair their credit ratings

- Prefer a pre-qualification card that will immediately inform them whether they would be approved prior to applying

- Want to double their credit line by up to $1,000 by making their first six-monthly minimum payments on time via Surge Card Login

- Don’t want a secured credit card or can’t afford a security deposit

- Want a card that reports activity to the three major credit bureaus

- Want the security of an optional credit protection program

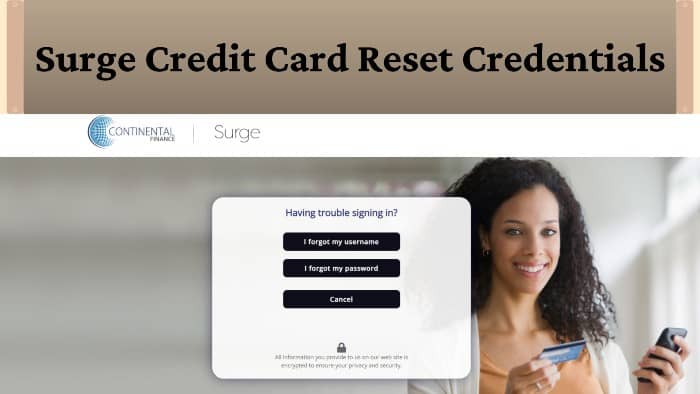

How To Recover My Surge Card Login Details?

It is no shock or surprise that most of us easily forget our passwords. Moreover, it is a natural thing. However, there is no need to worry. The surge credit card provides a very handy way to recover your login details. Here are the topmost steps on how to recover your username or password:

- Go to the webpage yourcreditcardinfo.com.

- Under the Surge Card Login button, you will see the” Forget Username or Password” button on this page.

- Click on that “Forget Username or Password” button to open up a new page. This will ask for the Information regarding the Card and account for verification.

- Once verified, you will get your credentials back in a matter of a few seconds.

How To Make Your Surge Credit Card Payment

If you want to pay your bills for Continental Finance Credit cards, you can make them online, over the phone, or send checks to the pay box.

Pay Online: We have explained the Surge Credit Card login steps above. Please follow that, and once you are on your due section, click on the play button. You will be asked for a few personal and Bank details, from which payment will be debited.

Pay Via phone: Dial 1-800-518-6142, follow the IVR, and provide some personal and bank details to make the payment

Pay via mail: Send payment checks to

- Surge Card

- PO BOX 6812

- Carol Stream, IL 60197-6812

App: You can also make your Surge Credit Card Payment through the Continental Finance mobile app for iOS and Android.

Surge Credit Card Benefits & Features

Benefits

The Surge Mastercard credit card is accessible to consumers with a wide range of credit scores. It’s an option for those who have difficulty getting approved for an unsecured credit card and don’t want to give a security deposit as a secured credit card requires.

As you use the Surge credit card, your usage will be reported to all three major credit bureaus TransUnion, Experian, and Equifax. With on-time payments, low credit card utilization, and responsible use, you can build up your credit score and eventually qualify for a Surge Card Login.

You may also be eligible for a potential credit limit increase after six months of making the required minimum monthly payments. This can help lower your credit utilization, which is another factor that can positively impact your credit score.

Surge Card Features

- All credit types are welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $500.00!* (subject to available credit; See rates, fees, costs, and limitations)

- With the fast and easy application process, results are provided online.

- Use your Card at locations everywhere that MasterCard is accepted.

- Free online account access 24/7

What Does Surge Stand For?

The Surge Card is a credit card designed for those with limited or damaged credit. Celtic Bank, the Card issuer, considers applicants with substandard credit. But, unlike most cards aimed at the subprime market, it is not a secured card, and no upfront security deposit is needed upon approval. The Card’s servicer, Continental Finance, reports your payment history to all three credit bureaus (Experian, TransUnion, and Equifax), Surge Card Info which allows cardholders to build credit with responsible use.

The Surge Credit Card can help you achieve your goal of improving your credit history, but it will cost you. The Card could come with a high annual fee, depending on your creditworthiness. Along with that potentially high annual fee, the Card is equipped with a monthly maintenance fee beginning with your second year as a cardholder. Additional costs apply for authorized users, cash advance purchases, and foreign transaction fees. These unappealing charges mean the Surge should be considered a last resort to boost your credit.

Steps For Surge Card Application

There are three different methods you can apply for the Surge Credit Card; online, via phone, or by mail. The online application method is available via the official website. It is very easy and fast, and you will get instant results about your eligibility for getting the Card.

- Go to the official website at https://www.surgecardinfo.com/.

- Click Apply Now to start the application process with Surge Credit Card Login

- Provide your personal details, which include name, address, financial details, contact details, etc.

- Tick the checkbox to check if you pre-qualify for the surge card before submitting a full application.

- Click See Card Offers options at the bottom of the application form.

- Based on your pre-qualification, you will see all credit card offers you can apply for.

- Click the Apply link on the official website for Surge Card Info and fill out the online application form to get the card mailed to your address.

Contact Customer Service

You can call 1-866-449-4514 for automated customer service at any time, which is available 24 hours a day, seven days a week. To actually speak with someone, Customer Care Specialists are available at Surge credit card customer service by phone Monday – Friday, 7 am to 10 pm, and Saturday 9 am to 1 pm Eastern standard time. Cardholders that have lost their Card can contact 1-800-556-5678 to report the issue.

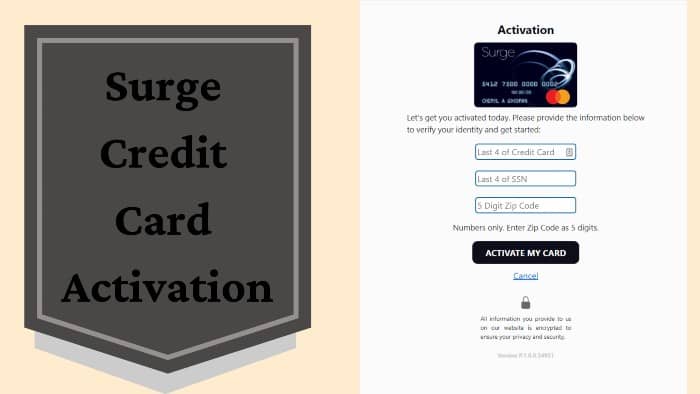

Step-By-Step Guide For Surge Card Activation

You can’t use your new Surge credit card / Mastercard before activating it online. Yes, if you recently received it online via mail or by post, you need to first activate your Card and then use it for any purpose. Therefore, there is no doubt that the Surge Mastercard Login activation should be the first step toward card usage for any doubt you can contact Surge Credit Card Customer Service.

Right after activating the Card and following Surge Card Info, you will be eligible to login into your Surge Credit Card login account and enjoy the premium benefits of the Card. So, without wasting your single minute, let you provide steps to activate the Surge credit card.

- To start with, open a web browser to visit the card activation page on your mobile or pc. With this, you will be landed on the main Surge credit card activation site www.surgecardinfo.com.

- On the home page, you’ll notice to provide three credentials. To activate your Surge credit card, make sure to enter the following information:

- Credit Card’s Last four digits

- Zip Code (5 Digits)

- SSN’s last four digits

- Only put all these needed Information into their appropriate boxes. Proceed further!

- After you’ve provided your Surge credit card information, tap on the “Activate My Card” button. With this, your Card will be immediately activated, and you can effectively begin using the Surge Mastercard Login.

| Official Name | Surge |

|---|---|

| Portal Type | Login |

| Portal Purpose | Surge Credit Card Services |

| Mobile App | Available |

| Country | USA |

Surge Credit Card App

It’s often easy to manage Surge Mastercard Login accounts online or through the Continental Finance mobile app. It is also available for Apple and Android smartphones.

With the Card Manager mobile app, you can view current and past transactions, make payments, update your contact information and report a lost or stolen card. Your VantageScore credit score is also available free of charge with the Card. Get your score updated each month when you sign up for online statements and Surge Credit Card Reviews.

Apply For a Card by phone:

To apply via Surge Credit Card App, you are to call the customer service number at 1-866-513-4598 and provide some basic information such as.

- Full name

- Social Security number

- Date of birth

- Physical address (No P.O. Box)

- Estimated gross monthly income

Frequently Asked Questions

What Information do we need for the Surge Credit Card application?

- Your First, Middle, and Last names

- Email Address

- Your Mobile number, including the supplementary phone number

- Residential Address

- Employment details and the rest of them

Does the Surge Credit Card Give Credit Increases?

Like most credit cards, Surge Mastercard offers credit enhancements to eligible consumers. Customers start with a line of credit between $300 and $1,000 and are eligible for a credit boost in just six months you can get more info at Surge Credit Card Customer Service.

Can I manage my new Surge card account online?

Yes. You will be able to enroll in our Online Banking Service to do all of the following actions with your My Surge Card Info and more:

- Make a Surge credit card payment

- Enroll to receive online statements for your My Surge Card

- View recent transactions

- View previous statements

- View payment history

- View your balance and other important My Surge card info

- To do so, you simply need to sign up and get your Surge login information. Then you can access your Surge credit info anytime, 24 hours per day, seven days per week.

Last Note

Surge Mastercard Login is designed to help you build a solid track record. Continental Finance, the card issuer, routes your account activity to the three credit reporting agencies. Categories include Experian, TransUnion, and Equifax to ensure payments are made on time.

Most major credit cards fall under the three credit bureaus, and this function is pretty straightforward. However, some credit cards for people with bad credit do not. It’s a must if you’re looking for a card to build your credit.